They must amount the money and you may get ready an announcement of your own currency and you can data files discovered. Each other need indication and you will attach the fresh report to your bill one to the new teller/cash clerk in past times closed to the change money. The newest funds and you can documents is up coming healthy. So it section will bring administrative directives and you may processing procedures for remittances inside the University Put Surgery.

G. Techniques Form 1041 taxation statements having MFT 05 to your correct income tax months having Exchange Password 610. C. Look at Web page 1 of the degree function to own tax episodes and number becoming taken out for each and every taxation months. Make certain such dollars quantity harmony if just one payment is actually registered.

Techniques which have TC 670 should your Evaluation has released plus the taxpayer sent in an old find. More than one Form 5330 can be post to your exact same component. In the event the just one remittance are acquired with well over you to Setting 5330, the brand new remittance shouldn’t have to end up being split in case your EIN/SSN, Taxation Months and you may Plan Count are exactly the same for each function.

- Less than.The fresh transmittal include zero remittancesroute Transmittal Layer and all sorts of documents so you can Bill and you can Handle High quality Opinion, Mail Avoid 6055.

- Channel the package out of come back to EP Entity, M/S 6273, as opposed to Batching.

- The new Deposit form will keep a duplicate of the Form 9814, Function 3210 and you will Setting 813 and you will affix to the new batch declaration and keep maintaining to have 36 months.

- If the taxation go back otherwise file try incorrectly listed, re-enter in the correct matter.

- (Taxpayer tend to mean using the phrase Federal Tax otherwise comment on their/their Form 1099 to own backup withholding).

- Give from the elizabeth-mail for the Wednesday morning, the full bucks and you will issues transferred for the Tuesday.

Instead of automated transmits, you could come across tips guide transmits to choose when to transfer your own money. Their money was found in the Rectangular equilibrium, and you may pick when you should yourself import them to the connected checking account. Your own money will get to your finances another day—from the no extra rates.

Keep in exact same succession order since the designated data files. Send source documents, remittances, and you will adding host recording so you can Guidelines Put for additional control. Desires to improve an order Code URADD Unfamiliar type in mistake is to be coordinated to your Not known Team in the Bookkeeping, since the Bookkeeping accounts for the fresh ethics of one’s Unidentified database.

Sikkimbet – Exactly how a deposit Functions

C. Executives tend to fill out the brand new employees’ OTCnet Affiliate Authorization Setting and Legislation out of Conclusion Setting for the LSA to be provided use of OTCnet. B. The fresh OTCnet representative Authorization Function and you can OTCnet Laws from Behavior Function confirming winning completion of training is available from the university LSA. C. Proposes to bid or 1st payments under an excellent deferred payment selling from gotten property. B. Also offers out of potential bidders away from repayments to your sales of caught possessions.

B. In case your box partly II is appeared, or if perhaps you will find records on the Setting 8892, and is also linked to the Setting 8892V, channel for additional handling. In the event the Box 9 are seemed on the Setting 4868, consider punctual recorded in the event the postmarked by the June 15th, or even the basic working day later in the event the fifteenth drops to your a week-end otherwise vacation. In the event the box II of your own Setting 4868 are requesting an extension both for “YOU” and “Your lady,” go after more than per taxpayer. D. Just after remittance processing is carried out, channel Form 1041T to Profile Management. A great. In the event the for one taxpayer, processes all the models with all the most up to date at the top. B. Detach all of the communications, produce remittance amount, acquired go out and you can approach to suitable mode.

When tourist’s inspections are acquired by post, evaluate the newest prevent signature on the brand new trademark. If your signatures suits, processes the fresh payment. Continue remittance having source file; do not staple together. Prior to control, remove look at stubs and you can people basics connected.

- Private checks removed to the Federal Put aside Bank or one Federal Department.

- Publish the entire plan along with data files integrated to Accounting in the your campus.

- Processes the newest remittance since the a surplus range, ready yourself Form 3244.

- F. Modify “S” and you can level of production/documents inside upper kept place away from remittances and you will productivity/documents.

- An automated Form 5919 is given to your director.

- Is Function D, RAIVS Requests Income tax Come back Photocopy away from Taxpayer Submitted Output, proving required items that were partial and you will determine a new consider is necessary.

If remittance is actually canned as a result of ISRP you don’t need so you can input the fresh levy source. The lending company trans information is captured as a result of ISRP and you will downloads for the the fresh Taxpayer Delinquent Membership for the Levy Origin File. Must be corrected a similar go out before right away control away from Not known data to prevent a great RACS away from equilibrium reputation for the URF File. Play with a good numbering machine to help you stamp the fresh unfamiliar remittance manage matter on each supply file. The brand new DLN try an excellent 14-finger handle matter allotted to for each origin file.

D. Dollars away from lower than $ten.00 obtained having a rejected Mode 4506 may be transformed into a fund buy and you sikkimbet can gone back to the new taxpayer by typical send. Be sure Mode 4287, List from Discovered Remittances, is actually annotated “return to taxpayer” and initialed by director just before emailing. Since the majority loan providers encourage “account information” that is complimentary, wants copies is going to be few.

Checks from the same financial with the exact same direct number can also be be manufactured to your one ELP deposit admission. Don’t enter in a great levy origin of a corporate or corporate consider to help you an individual account. Prepare Setting 813A out of including machine tapes, get ready Function 784 and OTCnet 215A Put Admission. Send data files, Mode 813A, Function 784, OTCnet 215A Deposit Solution and you can second backup from encoding tapes so you can Accounting.

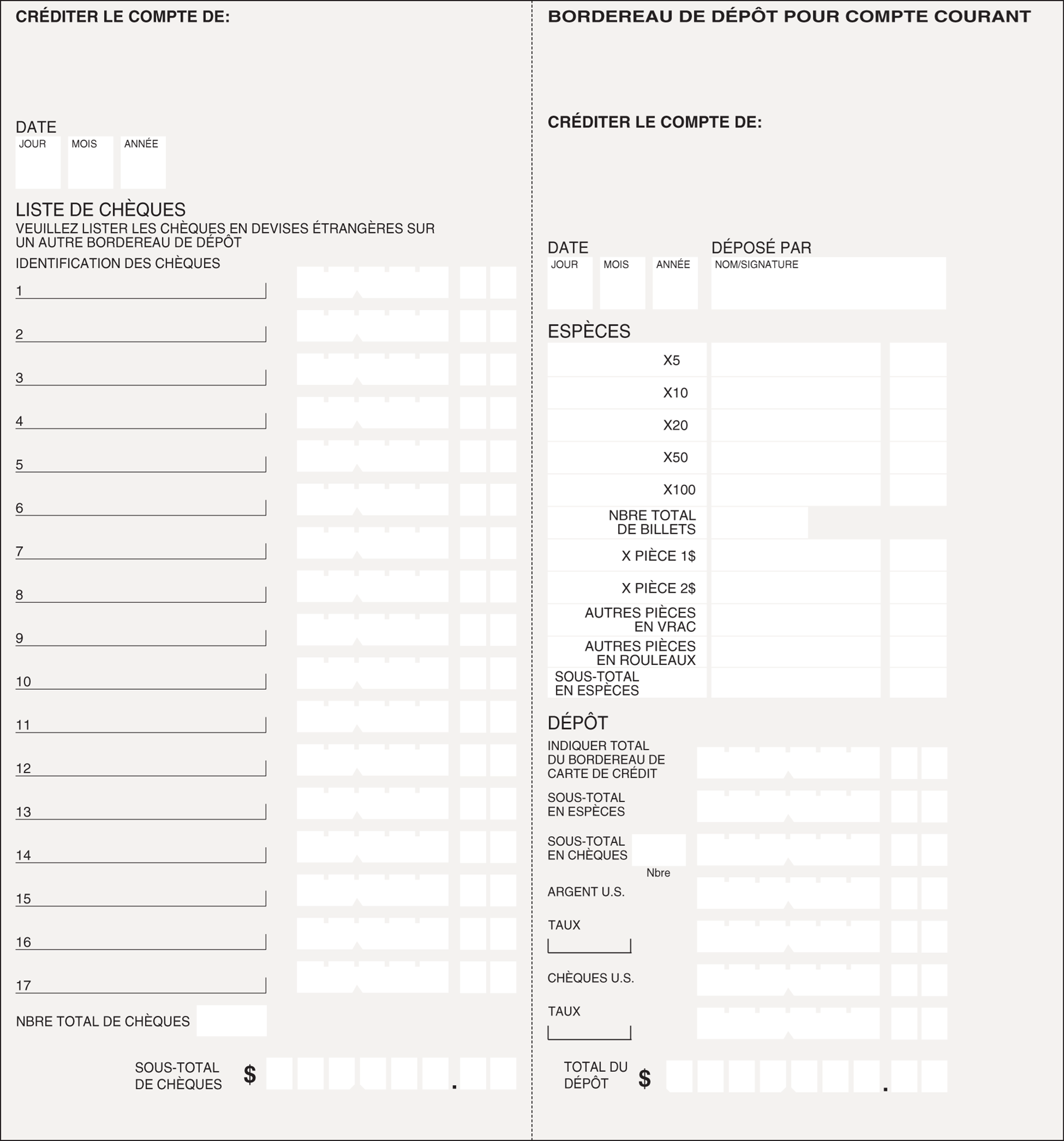

Incapacity to include this information can lead to your deposit getting came back. D. Returns/files prepared for guide running. I. Create bucks, checks and money sales, and you can revise huge complete within the environmentally friendly for the Form 4287 lower than take a look at and money order total. H. Create inspections and money sales and you can revise full within the environmentally friendly to the Form 4287 column Grams once bucks complete. A good. Test the box so that the desired data is actually sealed. Should your payment is forgotten, instantly contact the state to help you hold the destroyed suggestions.

We enjoy your for getting back into you in the newest Area. I would ike to chime within the and provide specific clarification about the deals inside banking. Click on the bank and choose the new purchases to help you ban. From the Weeks Ahead To enter community, you could lay exactly how many weeks in advance QuickBooks have a tendency to list the fresh put.

Does All the Put Built to a lender Earn Desire?

Basically accomplish that Perhaps I comprehend the a few rectangle icons. Fool around with, by you otherwise you to definitely client, in one single avoid merchandise that clients will likely be charged to own. The entire rate boasts the item rate and you may a purchaser fee.

Adding host tape is optional to have repayments canned through Information Hook because of the Percentage Brilliance Party, while the ISRP does not undertake the fresh costs unless of course they equilibrium. A parallel remittance (also referred to as “Multi” ) are two or more remittances gotten that have one come back/document. Whenever multiples need to be canned, pursue actions below. Campuses you to definitely found such variations that have payment may use the proper execution as the origin document. To own money received from the a campus other than OSPC, put the newest take a look at following a good-g over and you can station the newest Accounting plan to help you Accounting for moving to OSPC. If Form 5500-EZ try received with remittance and you may Form are linked to the earliest income tax months, hold the plan together.

The brand new Receipt and you may Control Surgery Director have to have a contingency plan for days if the depository you to gets the each day put is signed, as well as the Irs university are discover. Internal revenue service team other than Remittance Perfection Aspects which have IDRS access and you may badge access to the fresh Bill and you can Control restricted urban area, must have IDRS Order Password RSTRK with Definer You placed into the IDRS character. Professionals away from components finding discover remittances must perform monthly reviews out of Receive Remittance Logs, Form 4287, and take compatible step to prevent otherwise eliminate mishandling out of invoices.

And, it’s got a manual percentage program way to deposit to your website. There is a rank program on the website, pages can perform some of the scores to earn out of money and certainly will open positions badges. You to affiliate can also be import the newest financing for other pages. There is a good investment and put bounty readily available.

For every campus would be guilty of distribution and receiving readers to own resolve and you may/or replacement. The brand new Readers try an item away from Motorola Choices Inc. and you can requests for maintenance can be produced on the-line or because of the telephone because of Zebra Technology. E. If the scanner does not identify the fresh SSN, play with Demand Password TPIIP. Refer to IDRS Command Codes Jobs Support. Command Password TPIIP spends the past five digits of your own SSN and the very first 10 letters of your own history term to find on the complimentary name and you can address.

A. The first Form 10160, Receipt to have Transportation away from Irs Deposit, with bank’s acquired date, time of receipt, posted label and you may signature away from bank associate just who received the brand new deposit from the a specified depositary lender. An excellent. Whenever a good courier solution employee which looks to the CDAL provides started discharged from their/her obligations. B. Each day amount of debit coupons and put passes processed. A. The fresh DDR would be to secure the put date, Integrated Entry and you will Remittance Running deposit volume and you can count, manual put volume and count, as well as the total volume and amount of the fresh shared places.

A good around three-hand Plan Count need to be establish. If no Bundle Number is available, get in touch with OSPC Entity. Channel Setting 5558 to help you OSPC Password and you may Revise Form.

D. Immediately after running, keep for 5 months and shred. D. Once processing, keep for five weeks then shred. Techniques the newest get back and you will percentage depending on the remittance found inside the Part I, Line twelve, and/otherwise Region II Outlines step 1-ten to the return. Always check cross-referenced TIN to be sure best posting. If the get back hasn’t published, input an excellent TC 610 to post the new commission. In case your lender charges more so you can processes the new clear arm due to ISRP, put due to Tips guide.

If not, article the past seasons Form 1040V coupons having TC 610. Matches the fresh income tax amount found on the Setting 4720 , Area We, Range 12Process the new get back because the Mode 4720. Blog post the newest remittance having TC 610, MFT fifty.Matches the fresh taxation found in part II Contours step one-10Process the fresh get back as the Setting 4720-A good. Blog post remittance to NMF having TC 610, MFT 66. If it is not offered, article the fresh remittance for the Company’s EIN playing with TC 610, MFT fifty.

If an officer remits a blog post-old check in error, matter Setting 5919 Teller’s Mistake Information. An automatic Setting 5919 is actually given for the manager. Get back the brand new check with the fresh effect you’ll need for a type 5919.